Insurance coverage across borders can be tricky. And it’s one thing you don’t want to leave behind, especially when it comes to your health. If you’re gearing up for a winter in Baja or a quick visit anywhere in Mexico or beyond, SafetyWing’s Nomad Insurance should be on your must-have list.

With Nomad Insurance, you get the critical medical care you need no matter where you go. Whether you are seriously injured or come down with a nasty bug, this Baja travel insurance for your health is there to save the day.

In this quick article, we’ll help you understand why we love SafetyWing’s Nomad Insurance and choose it as the best for emergency Baja travel insurance coverage. And we’ll run through the basics so you can get the coverage you need before you cross into uncharted territory.

We link to products and services we think are useful for our readers. We may earn a commission for purchases made through some of these links. There’s no extra cost for you and it helps support our work. We really appreciate your support!

Disclaimer: This information is for educational purposes. We make no guarantees or warranties about the specifics of insurance coverage. It is your responsibility to verify any and all coverage details.

Why We Love Nomad Insurance for Baja, Mexico

You don’t have to consider yourself a digital nomad to fit under the nomad insurance needs. In fact, this health insurance is ideal for almost anyone who travels outside their home country and wants to have coverage for emergency medical care.

The big difference is that it’s meant for longer term use. That’s the nomad aspect of Nomad Insurance.

For a lot of Baja travelers, you’ll be visiting for weeks or months on end. This is where Nomad Insurance can step in, both while you’re in Baja and while you visit other countries. It provides essential health coverage, such as:

- Ambulance and emergency care

- Pain-relieving emergency dental care

- Diagnostics, prescriptions, and more for sudden illness or injury

- Emergency treatment of preexisting illness or injury

This coverage can last up to 364 days. That means you get year-round coverage, no matter where you go. And it offers bite-sized recurring payments with no commitment.

For many of us that spend winters away from home, having this emergency coverage can really help you sleep like a baby. You don’t have to worry about emptying your bank account if something big comes up. It’s a level of confidence that you just can’t get without excellent emergency care coverage, even if you have one of the best first aid kits in town.

Note: Nomad Insurance and travel insurance are not the same as health insurance. This is for emergency care only. If you want to get health insurance for routine coverage and extended stays in another country, you’ll have to look for other coverage.

|

SafetyWing Nomad Insurance |

Get It Now |

Essential Coverage

The main reason to get Nomad Insurance is to get emergency medical care anywhere you need it. Whether you’ve just crossed the border and have a freak accident, or you have a nasty stingray encounter on one of Mexico’s most beautiful beaches, you want to be able to seek emergency medical care without financial concerns.

But the essential coverage included with every package goes beyond that. It also includes items that you may think of as more traditional Baja travel insurance:

- Evacuation to a better hospital when needed

- Reimbursement for lost luggage

- Flights home if something serious comes up, like a death in the family

- Meals and accommodations for travel delays over 12 hours

These might seem like relatively small concerns. And you’re right. In comparison to the other emergency care needs, most of this list are much less series issues. But they’re still a great way to forget anxiety while traveling.

Another way to make sure you’re in good hands, especially while in remote areas found all over Baja, is by getting a Garmin inReach for your travels. This device gets you in touch with emergency responders around the world and is a great companion tool to have with Nomad Insurance coverage. You can also use it to send text messages to friends or family while away from cell service.

Add-On Policies

The optional coverage can be extremely useful as well. There are three main add-ons for Nomad Insurance, and many of them apply perfectly to those that visit Baja and other parts of Mexico. Some of these policies may not be available to US residents.

First is the optional US coverage. While it is NOT available to US residents, this can be ideal for Canadians and others traveling through the US. It’s one place you really don’t want to get caught without insurance due to the extremely high healthcare costs. A simple emergency room visit can quickly cost thousands of dollars.

Next is the adventure sports package. For many of us, Baja is synonymous with adventure. From renting quads in San Felipe to kiteboarding in La Ventana, there’s always something fun to do.

While a lot of health insurance coverage options exclude these activities, SafetyWing’s Nomad Insurance allows you to pay a tiny bit extra to make sure you don’t have to foot the hospital bill if the worst happens. This is part of what it Nomad Insurance our number one choice for Baja travel insurance.

Finally, you can purchase electronics theft coverage. This offers a very nice peace of mind to those of us that bring down expensive gear. It’s a supplemental policy that can help get back some funds from stolen gear.

As a reminder, personal property (like electronics) inside of vehicles are usually NOT covered by auto insurance policies. Even with the best Baja insurance. And don’t forget that most US car insurance policies don’t work in Mexico.

To be well covered, many visitors want to get both Baja car insurance and Baja travel insurance for medical emergencies.

Cost and Flexibility

Travel insurance can be overly expensive, especially for long-term travelers. The traditional insurance model is made for people taking short vacations. Insurance companies translate this to more risk, which means higher cost.

SafetyWing’s Nomad Insurance is different. It’s a 21-st century product that recognizes the different risk. And it’s specifically for those who travel regularly or spend time in one area that’s away from their home country.

By focusing on this group, there are two giant benefits:

- You can pay in monthly installments, without any commitments. Feel free to cancel at any time.

- The prices are much more affordable and reflect the fact that you’re not a crazy weekender or vacationer going nuts for 5 days. You’re a nomadic semi-resident.

For many people, the cost of this emergency health insurance for Baja, Mexico (and beyond) is ideal. It’s often quite affordable compared to home costs.

Baja, Mexico and Beyond

We are big fans of Baja, Mexico and do a lot to help people safely explore this wonderful gem. And one reason we love Nomad Insurance is that it fits in with the Baja lifestyle so well.

Going to Mexico can seem nonchalant at times. Whether you forget your FMM because Mexican immigration doesn’t forcefully stop you at the border (like many other countries) or you jump back and forth so often it feels like home, you might not realize all that happens when you cross the imaginary line between countries.

The truth is that it is a critical juncture, especially for insurance purposes. Quite often, insurance coverage stops at your country’s border. In the US, it even lacks normal coverage just when you’re outside of your home state.

Many of us know that Baja Bound is perfect for auto insurance coverage. And you may not have worry about the usual renters or homeowners insurance..

Health insurance is a different story. And even though Mexico’s costs can be lower than other countries, serious medical care costs can skyrocket very quickly. Having health insurance for your Baja visit is key.

Plus, this Nomad Insurance doesn’t just cover your trip to Mexico. You can keep it going throughout the year. Or stop and start it as you need to cover trips elsewhere. For big travelers, it’s a great way to make sure your insurance always sticks near your side.

|

SafetyWing Nomad Insurance |

Get It Now |

Our Experience: Simple and Fast Sign Up Process

While we love hearing all about the positive stories people have with SafetyWing’s Nomad Insurance, our favorite part is the sign up process. With just a few clicks, you can easily and instantly get the coverage you need.

We all have a lot on our plates. And gearing up for a big visit to another country stacks even more on top.

Having this simplified and straightforward sign up helps take the hassle out of the equation. If you go over to the Nomad Insurance form right now, you can have health insurance anywhere you need it in less than 10 minutes.

Here is a brief overview of what the sign up process looks like for your travel health insurance policy through Nomad Insurance.

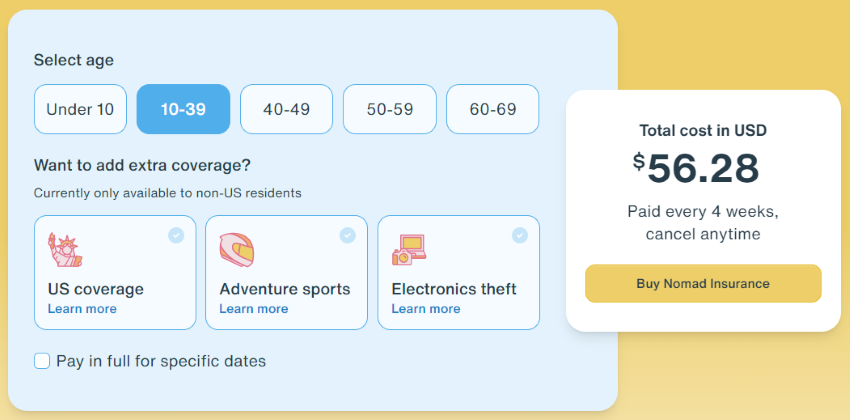

Age Group and Add-On Options

The starting screen is a very basic rundown that just requires you to do one thing: choose your age group. After doing so, you’ll immediately see a price quote for the next 4 weeks of coverage. Nothing tricky about it. Straightforward and transparent.

At this stage, you can also decide if you want to get the add-on packages. This is US coverage (for non-US citizens/residents), Adventure sports coverage, or Electronics theft.

As you select any optional coverage, the quote on the right side immediately changes to reflect the added package. It doesn’t hide the punchline until you’ve been 30 questions deep. In fact, 30 questions is not part of SafetyWing’s application in any way.

Personal Details

Next up is a few personal details. But Nomad Insurance doesn’t require you to pull out a family tree or write a deep history on your entire life. We’ve completed other insurance forms that look like a book compared to this. It’s about 4 easy questions that you can answer without looking anywhere.

Things like your name, birthday, country of citizenship, and principal place of residency are on here.

At this point, SafetyWing lines you up with the best option for your specific coverage needs. And they’ll mention if any specific packages are available or not.

After that, you’ll fill in a few more details, including your sex and where you’re traveling. And to make it so your travel partner doesn’t have to complete the entire process again, you can add people to the coverage right away, with the same simple details as yourself (name, birthday, address, sex, and citizenship).

Payment and Policy

The final step is payment. Nomad Insurance accepts a wide variety of credit cards, including Visa, AmEx, and MasterCard.

You can choose to pay:

- Every 4 weeks for ongoing coverage, or

- Provide an end date for your trip and pay for the entire cost upfront.

This flexibility is another thing we love about SafetyWing’s Nomad Insurance. If you know the end date and want to make sure you only buy what you need, go for it. But if your plans have some flexibility, paying every 4 weeks is a great way to keep the coverage you need for as long as you need. We’re huge fans of coverage that doesn’t require major commitment.

Want to extend your trip? No problem. Going to cut it short to run back home? Not an issue. Planning on jumping on a plane and going elsewhere? You can have that covered with your emergency medical coverage for Baja too.

Once you put your payment through, you’re ready to hit the road or head to the airport with a new level of confidence.

You’ll have the SafetyWing Nomad Insurance online portal to always view and update your policy as needed. You can start an instant chat at any time, send an email with a rapid 1-2 hour response (at most), or pick up the phone to call a trusted member of the SafetyWing customer support staff.

Plus, it’s where you can go if you want to file a claim, which is unbelievably easy. And this adds to the pile of reasons why we love Nomad Insurance.

|

SafetyWing Nomad Insurance |

Get It Now |

Nomad Insurance Claims Process

If you do have an incident and need to make a claim, you will be in good hands with SafetyWing’s customer support and Nomad Insurance claims process. It’s straightforward and makes it just about as painless as it could be.

When an emergency comes up, your number one priority is getting the care you need.

And the great thing is that you can have a ton of confidence knowing your emergency medical needs will be covered. It doesn’t matter if you visit a public health facility or a private care provider. Nomad Insurance coverage works for both.

When you have a chance, you’ll want to immediately reach out to Nomad Insurance. They will quickly answer questions and ensure that you take the right steps to get your claim covered. Certain types of coverage can only happen if you contact Nomad Insurance first, such as costs to move to a better equipped hospital.

There are two ways that payment and claims can be handled:

- You pay the provider, file the claim, and Nomad Insurance reimburses you directly

- Nomad Insurance pays provider directly

For big-ticket expenses, Nomad Insurance may be able to pay the provider directly. In other cases, simply proving that you have emergency medical care may alleviate concerns any provider has at offering help before payment.

Submitting a claim is quick and painless, usually taking 5 minutes or less. You file the relevant reports and receipts, tell Nomad Insurance where you want the money to go, and you’re done. If they need more information, they’ll reach out to your or the medical provider.

Customer Feedback

Don’t just take our word for it. SafetyWing has an excellent reputation, far above the norm for insurance industry companies.

You can read tons of real user experiences all over the place, with over 1,200 TrustPilot ratings and hundreds of reviews on ProductHunt.

We won’t sugarcoat the negative experiences. After all, this is the insurance business. SafetyWing does a simply phenomenal job at providing emergency health coverage, but they are a business and don’t pay out claims for expenses that are not covered.

This is why we highly recommend two things:

- Reach out to Nomad Insurance as early as possible during an emergency. With their guidance, you can have a better understanding of what’s covered and what isn’t.

- Carefully read through your covered insurance and the FAQs page to better understand the specifics of your policy. If you aren’t certain about something, reach out to Nomad Insurance. Do this before you need it.

It goes without saying, but we’re going to say it anyway. You also want to avoid taking unnecessary risks or being an idiot. Like nearly any insurance policy, there are many ways for this to not pay out if you’re are entirely at fault. Speeding down a road at 4am with a bottle of tequila is not a good way to start a claims process.

Just as how your homeowners insurance won’t pay out if you burn down your home, your emergency Baja insurance isn’t going to cover you getting hurt when you’re doing illegal or overly risky things.

|

SafetyWing Nomad Insurance |

Get It Now |

Wrap Up: Our Take on Nomad Insurance

The adventure-filled lifestyle comes with risks. When you’re choosing to hit the roads less traveled or go far from home and venture into the unknown, you don’t want to be alone. SafetyWing’s Nomad Insurance provides peace of mind that you can’t get anywhere else, and it’s perfect for those looking to spend a good chunk of time away from home.

Head over to SafetyWing’s simple and quick application to get emergency medical insurance for Baja in minutes.

If you’re driving to Mexico, don’t forget to read about the Best Mexican Car Insurance providers. You want to avoid picking certain companies and we show you why.