Most of us do our best to stay out of trouble bu things don’t always go to plan. That’s where insurance comes in. When driving in Mexico, you want the best Mexican car insurance to meet local laws and insure your vehicle.

Navigating the brokers and insurance companies is a pain. I’m a legal and insurance expert with extensive experience in this market. And I’ve done the work for you. After reading this, you’ll have everything you need to buy the insurance policy right for your needs.

Let’s jump into the details of the best Mexican auto insurance companies.

We link to products and services we think are useful for our readers. We may earn a commission for purchases made through some of these links. There’s no extra cost for you and it helps support our work. We really appreciate your support!

Best Mexican Car Insurance: Top Brokers

Here is a quick summary of the main Mexican car insurance brokers offering policies to people with foreign-plated cars:

| Baja Bound Mexican Insurance | BEST OVERALL: Experienced broker with high-quality policies and superior customer service | – Chubb – HDI Seguros |

| Mexico Insurance Online | TOP ALTERNATIVE: Offers top-rated Mexico insurance policies and backed by reputable international company | – Chubb – GNP Seguros – El Aguila |

| Best Mex Insurance | Popular option that offers cheaper insurance policies from lower-rated companies | – HDI Seguros – Mapfre – Qualitas |

| Sanborn’s Mexican Insurance | Well-established broker that lacks transparency about the insurance companies behind their policies | Not transparent |

| Mex Pro Insurance | Nearly identical to Mexico Insurance Online, our preferred partner | – Chubb – GNP Seguros – El Aguila |

| Lewis and Lewis Insurance | Only provides cheaper policies from one Mexican car insurance company known for difficult claims process | – Quálitas |

| US Insurers (Geico, Progressive, Allstate, etc.) | Typically outsources actual coverage to a Mexican insurance specialist | Various |

Baja Bound: Best of the Best

Baja Bound Insurance is without a doubt our top recommendation as the best Mexican car insurance.

You can trust Baja Bound Insurance as your broker for any car insurance needs. They offer policies for Baja, Baja/Sonora only, and mainland Mexico. We recommend them with no reservations because they:

- Only offer policies from the most trusted Mexican insurance companies

- Have world-class customer service, online portals, and communication

- Are extremely well-known in the industry, trusted by thousands upon thousands people since 1994

Ready to see how much your Mexican car insurance cost will be? Head over to Baja Bound to get a quote in seconds.

Mexico Insurance Online: Top Alternative

The second Mexico car insurance broker that we recommend is Mexico Insurance Online. And if you want to shop around to make sure you’re getting the right policy for the right price, we encourage you to get a quick quote.

This broker is serious about helping international travelers get their insurance needs covered. It has a presence in many countries across the globe, connecting foreign visitors with the best local insurance companies. And they know Mexico.

Like Baja Bound, this broker sticks to highly-reputable insurance companies only. And it offers a streamlined online platform to get and manage your insurance. This is a much larger insurance broker that doesn’t quite have the same personal touch as Baja Bound, but it’s an excellent Mexican insurance broker.

Head over to Mexico Insurance Online right away to see how much your Mexico car insurance cost will be.

What to Look for With Insurance Brokers

We recommend you buy a Mexican car insurance policy from brokers that:

- Only sell policies from reputable insurance companies

- Offer high-quality coverage at the right price

- Has an established track-record of superior customer service

Reputable Mexican Insurance Companies

It’s wise to buy your Mexican auto insurance from a broker. These are businesses who connect customers like you to the actual local insurance company. They should carefully select the insurance they sell and help you through step.

Some brokers only sell from one cheap insurer to give the lowest price, knowing that the claims process is a nightmare. These insurance policies aren’t worth the paper they’re written on.

The best brokers carefully select the insurance companies they work with to find the right coverage at the right price. They should always offer more than one option of insurers. If they don’t, they are not shopping around for you. The price analysis across companies differs dramatically and a major part of any brokers job is to make sure you are lined up with a company with analyzes your risk properly.

High-Quality Coverage and the Right Price

In Mexico, we recommend these four insurance companies:

- Chubb (ABA Seguros)

- HDI Seguros

- Grupo Nacional Provincial (GNP)

- El Aguila

All four of these providers are known for having (1) excellent policy coverage and claims processes and (2) sufficient financial stability which allows them to pay out claims with ease (ratings in the “A” class).

Baja Bound Mexican Insurance provides policies from Chubb and HDI Seguros, while Mexico Insurance Online sticks to Chubb, GNP Seguros, and El Aguila.

Note: Major rating agencies, like A.M. Best & Co. and Standard and Poors (S&P), review records to see how stable the companies are. When it comes to insurance, this is a critical aspect to judge the company based on. Managing money well is a central part of any insurance company’s core business needs and if they can’t do that well, they’re unlikely to be a high-quality insurer.

You can find cheap Mexican car insurance from some brokers that use Mapfre or Qualitas coverage. These insurance companies are very popular with tourists and Mexicans mostly because they are cheap. They have lower financial ratings (in the “B” class) and leave a trail of terrible claims in their wake.

Superior Customer Service

The best Mexico car insurance brokers show you options from multiple insurers. They also help you understand the options and communicate with the insurance company if something goes wrong.

The ones we recommend will offer:

- Help navigating unfamiliar legal and insurance systems

- Additional support in your language

- Established contacts at the insurance companies, with known adjusters and representatives

The best brokers, like Baja Bound, provide extremely valuable services. They have all the knowledge you need, are eager to help, and have a deep and powerful relationship with insurance companies.

Crucial note: Baja Bound Mexican Insurance for Mexico is NOT legal representation. They do all that they can to back their clients. But in nasty insurance situations, sometimes you need to hire a lawyer to deal with the insurance company on your behalf.

Don’t forget, all tourists need permission to be in Mexico. For most people, this means getting the FMM Card for Mexico.

Baja Bound Insurance

I’ve driven many thousands of miles on roads across all Mexico, done countless hours of research to find the best insurance, and talked with countless travelers about their experiences breaking down, making insurance claims, and even the dreaded police encounters.

And if there’s one thing I’ve learned, it’s that Baja Bound Mexican Insurance is the best. Without question.

This insurance broker started out in 1994 serving people crossing at the San Diego and Tijuana border area. They went online in 1999, well before many other companies took the internet seriously.

And today, Baja Bound provides insurance policies for Baja and all of Mexico with excellent service.

Baja Bound is regulated by the California Department of Insurance (license number 0D25373). And they are Direct Agents for the insurance companies they sell policies for. They have well-established professional relationships with them.

They only offer policies from Chubb and HDI Seguros, both are financially-stable (A+ or A++), high-quality insurance companies. Most of their policies include settling claims in US Dollars when possible and providing US or Canadian labor rates, along with a wide array of other features and possible add-ons.

Baja Bound Customer Service

One of the best things about Baja Bound Insurance is their exceptional customer service. They have knowledgeable representatives a phone call or email away, ready to assist with nearly any insurance need you have. They can help you buy the right Mexican car insurance policy for your vehicle, boat, and even home.

I can personally attest to their staff and have bought policy after policy with them. One time I had my insurance needs slip my mind and realized it on the afternoon of the day it was expiring. They jumped on it and helped me extend my policy, saving me hundreds if I would have waited until the next day.

And I’m not the only one. Take to Facebook or other social media and you’ll find story after story of Baja Bound going above and beyond to be there. The company has a serious commitment to customer service.

I have read some unfortunate situations where people didn’t understand Baja Bound’s role and took out their frustration on them for the insurance company not paying a claim as desired. As discussed above in detail, Baja Bound is a broker. They’ll go out of their way to help you, even with claims, but the insurance company is the one who actually decides to pay claims or not.

If the insurance company isn’t doing what you need and there’s a lot of money on the line, hire a reputable local attorney.

Baja Bound Coverage and Insurance Options

You only need the basic details of your trip (dates and location) and your vehicle to get an instant quote. You don’t have to even make an account first. That doesn’t happen until you decide a policy is right and click Buy. An immediate difference compared to rivals.

Baja Bound will quickly show you the costs of the policy that they think suits your needs the best. It will clearly show what is included and at what level of coverage.

The policies that are usually best include Chubb or the HDI Premier. Both of these include the best coverage options and terms. Check your policy carefully to verify, but this should mean you get vandalism and partial theft, excellent tow coverage, rental car reimbursement, and US/Canada repair rates and shipment back.

Baja Bound will immediately show if you are better off getting a long term policy. Sometimes a 6-month policy can have a better price than a 1-month one. A strange part of Mexican car insurance prices that Baja Bound understands for you.

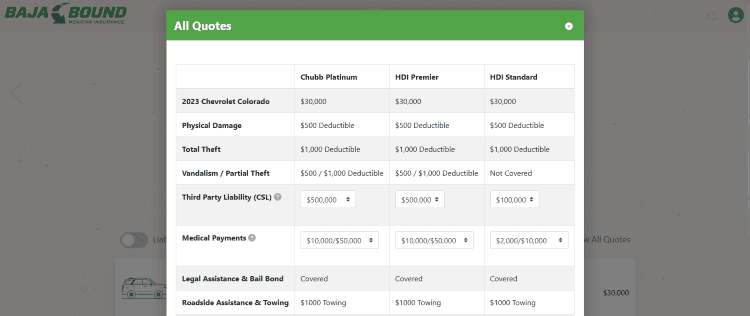

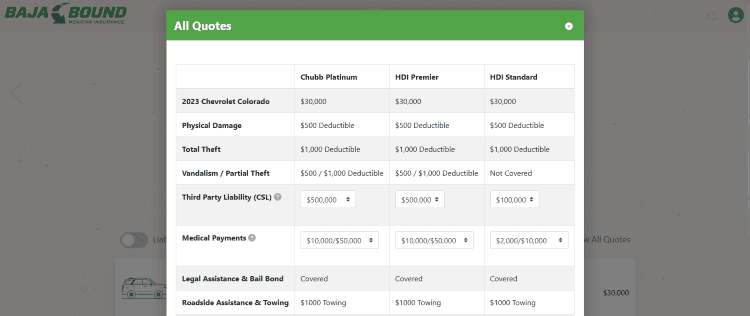

If you aren’t satisfied with the one option they selected, click the “View All Quotes” button. Then a pop-up with show their top choices and coverage included.

Once you find the best Mexican auto insurance policy for your needs, click Buy. That’s when you create an account, pay for it, and instantly buy your car insurance for Mexico. Couldn’t be easier or faster.

Get A Quote From Baja Bound

Baja Bound provides discounted policies if you are staying in specific zones, such as Baja only or Sonora only. But they also provide coverage for all of Mexico.

The Baja Bound portal does an excellent job at showing the difference between coverage, what is included, and the specific limits. Carefully review them to make sure they align with your interests.

Get a quote from Baja Bound right away and be prepared for your Mexican travels.

Mexico Insurance Online

Another top insurance broker is Mexico Insurance Online. This entity is backed by the International Insurance Group, Inc., a US-registered insurance broker (CA License Number 0D06599).

This entity is behind other big names in the best Mexico car insurance industry. Names like MexPro and even some US-based couriers actually run through International Insurance Group. Mexico Insurance Online is our preferred partner for this company’s amazing offerings.

Like Baja Bound, Mexico Insurance Online has been helping people obtain Mexican car insurance policies for decades. They started out in 1999 and provide insurance to over 100,000 customers each year.

They stick to three insurance companies, Chubb, GNP Seguros, and El Aguila. All three are well-respected names in the Mexican insurance market with “A” class financial ratings. And each policy has the protection you need plus many other benefits.

One thing that’s great about Mexico Insurance Online is that they have a straightforward website. You can get your quote for the best Mexican car insurance in seconds with very little details.

Contacting Mexico Insurance Online

This entity is owned and operated by International Insurance Group based out of North Royalton, Ohio. They are true international insurance experts, offering many Mexico car insurance policies, plus other insurance coverage within Mexico and in countries all over the world.

You can visit the parent company’s website easily, but you really don’t have to. Everything you need is on Mexico Insurance Online.

You can send an electronic contact form to them with your email and phone number. They also provide a phone number (844-273-5527) to immediately speak with a customer service representative.

The representatives are knowledgeable and easily answer any questions you have, before or after purchase.

They also help with claims if needed. You will mostly deal with the actual insurance company (Chubb, GNP, or El Aguila) to file and deal with your claim. But if things aren’t going to plan, you can contact Mexico Insurance Online for claim assistance.

Best of all, the rates they offer are very competitive.

Get a Quote Instantly with Mexico Insurance Online

If you want to get one of the quickest possible quotes, check out Mexico Insurance Online. You can find the cost of a Mexico car insurance policy within seconds. Then fill out the rest of the checkout policy in minutes and be all set for your big trip!

What I really like about this company is that they understand the needs of international travelers. Dealing with insurance claims can be tricky even in your home country. Going to a different country and needing insurance is another level of complications. But they are there to help you out.

Other Mexico Car Insurance Brokers

There’s no shortage of Mexican car insurance brokers. It’s hard to understand who is worth buying from and who to avoid.

After much research and tons of experience, Baja Bound and Mexico Insurance Online are the two brokers we trust. And we always recommend getting a policy from Chubb, HDI Seguros, GNP, or El Aguila.

In this section, I’ll go through some other major brokers and what it’s like to buy insurance through them.

I have no problem admitting that we’re very picky. Many people have used these brokers with complete satisfaction. But I’m here to dive deep into the details so you can get the best Mexico car insurance possible. This isn’t about buying things based on one Facebook story from someone who has never filed a claim. It’s the harsh reality of what’s lurking under the surface.

Best Mex

Best Mex is another fairly well-known broker. But I am not so thrilled about them. And it’s for a very important reason: the insurance companies that they work with include some names that aren’t as quite reputable.

You can buy policies from HDI Seguros through Best Mex, which is great.

But Best Mex also offers policies from Mapfre and Qualitas. Both of the Mexican car insurance costs from these two companies are usually lower. Which is tempting. However, it’s important to see what you get by saving a few bucks up front.

First and foremost, you can find no shortage of downright horrific stories from both of these insurers about the claims process. This applies to domestic Mexican coverage and policies sold to tourists. They simply make it very difficult to use the coverage you pay for.

They also fall in the “B” financial rating categories, which is a big step down for the “A” level categories at the top. And it shows that they aren’t as talented at managing money, a vital role of any insurance company.

When you’re buying insurance, you’re trusting the company to provide financial compensation. Buying a low-priced policy from a company that isn’t in the best financial position sort of defeats the entire purpose.

If you do go with Best Mex, I suggest sticking with HDI Seguros for better peace of mind.

Sanborn’s Insurance

Sanborn’s Insurance is another major Mexico car insurance broker, with roots in Texas. It now has over 20 locations throughout Texas, California, Arizona, Mexico, and Panama. This broker has a lot of experience and many physical locations.

But there is one glaring omission from Sanborn’s website: detailed information about the insurance companies they represent.

Sanborn’s homepage has logos of major insurance companies, including the HDI Seguros logo. But when you get quotes, they offer prices without the insurance company information. This is like buying something from a salesperson without knowing who the manufacturer is. Would you buy “beer” from your local store or do you like to browse brands? Would you buy home insurance from “insurance company” without knowing who it is? This really doesn’t make sense as the insurance purchase process.

Sanborn’s website has a lot of detail about their history. But almost nothing about the insurance companies they represent, what claims are like, what the coverage is like, and other critical elements.

That’s is a major problem. By failing to focus on the actual insurance coverage, it seems that Sanborn’s is putting their own sales techniques and numbers above the needs of the customers.

Another reason this is a problem with Sanborn’s is that based on everything I can see, you are only getting a quote from one insurance company.

Risk assessments vary greatly. One company might think your risk is extremely high, but another can say it much lower. The difference for your Mexican car insurance cost can be extreme. Almost all good brokers present options from more than one insurer.

MexPro Insurance

MexPro is an extremely well-known insurance broker that helps with Mexican car insurance and many other Mexico-based insurance policies. It sticks to top insurance companies, including Chubb, GNP, El Aguila, and ABA.

Do these names look familiar? They’re the same insurance companies that Mexico Insurance Online uses. And that’s because they have the same parent company. So to be honest, this is essentially the same broker in a different building.

I prefer the simplicity of Mexico Insurance Online’s portal. But MexPro is another trusted option that has the International Insurance Group behind it.

Lewis and Lewis Mexico Insurance

Lewis and Lewis has a large presence in many expat Facebook groups and forums. Even with travelers in casual discussions. They are another well-respected insurance broker for Mexican car insurance. And their website is easy to navigate.

There are two issues with Lewis and Lewis. They take the problems I found with Best Mex and Sanborn’s and combine them.

First, they sell Mexico car insurance from Quálitas, a company with a lower financial rating. It’s one of the biggest providers in Mexico, which is almost definitely because they offer low-priced policies that low-income people buy. If you want to have reliable insurance coverage for your valuable vehicle, RV, or boat, put your trust in highly-reputable companies like Chubb, HDI, GNP, and El Aguilas.

Second, based on what I can see, Quálitas is the only car insurance company Lewis and Lewis offers. As a broker, that is a major failure point. The price of insurance can be extreme from different insurance companies. A broker is supposed to be shopping for you to find the best. It’s by far the most important part of their job. Imagine going to a travel agent that only sold a travel pack for one location. I doubt you’d use them often.

At the end of the day, I know many people trust Lewis and Lewis. But Baja Bound provides quotes from multiple companies with some of the best ratings around. It also has a more modern website that’s easier to navigate.

Geico, Allstate, and Progressive

Some of these companies actually do offer limited coverage for your trip to Mexico. This will likely include some property damage coverage close to the border. It never includes the legally-required liability insurance.

To sell actual Mexican car insurance with liability insurance and other coverage options, these companies just partner with big names in Mexico. You lose the personal touch of a broker team and instead are put through a giant intermediary who is much less likely to help. In some cases, they go through a Mexican broker, stacking on an unnecessary layer which could mean you pay more.

Allstate has a full page about Mexico insurance. It can help you understand that you need car insurance for Mexico and that they partner with Mexico-based insurers to provide coverage. What Allstate doesn’t say is that they actually go through MexPro, owned by International Insurance Group. As stated before, I prefer getting access to the same policies through Mexico Insurance Online, also owned by the same group and with excellent customer service.

Progressive does the same thing. They’ve designed a quote page but the coverage is through this same company. Adding the Progressive layer on top of two other companies already is unnecessary. Head directly to Mexico Insurance Online instead.

Geico has a very similar informational page about Mexico insurance. And they use their own portal to provide quotes for GNP and El Aguila. They lack details and showcase that this is just a small side project for Geico. Compared to other top Mexican insurance brokers, they basically show you nothing.

At the end of the day, they aren’t Mexico-specific brokers and simply don’t have the expertise to help you. They just offer these as a small revenue stream and to help customers who aren’t aware of the high-quality Mexican brokers.

Mexican Car Insurance Basics

Let’s quickly review Mexican insurance basics so you can shop for the policy that matches your needs for cost and coverage options.

Cost of Mexican Auto Insurance

Understanding how much Mexican auto insurance costs depends on what you want. The main ones are (1) policy length, (2) the insured value, and (3) the coverage options and terms included.

Like any insurance, the longer your policy, the more expensive it will be. For Mexico tourist insurance policies, you’ll find that the shortest coverage (a few days to a few weeks) will be the most expensive per day. A 6-month or annual policy will be much cheaper per day. Buying Mexican car insurance for ~3 weeks will cost about the same a 6-month policy.

And of course, the value of your vehicle, boat, or RV also has a big impact on insurance price.

Terms and Coverage Options

These are the main coverage options you’ll have to choose between when buying Mexican car insurance:

- US Repair Rates: Have your vehicle repaired in the United States or Canada.

- Vandalism or Partial Theft: Typically part of premium packages and excluded from cheaper ones.

- Uninsured Motorist: Vital coverage where your own insurance pays for damage that others cause if they can’t pay.

- Roadside Assistance: Towing coverage of up to $1,000. Help with flat tires, dead batteries, and breakdowns.

- Bilingual Service: Some brokers/insurers provide bilingual staff to help with claims. Others do not.

If you get a premium coverage from a company like HDI Seguros or Chubb, these are all included. Low-quality insurance may or may not offer these as alternatives. And if you try to use them, they might be less likely to provide the same level of service that the high-quality insurers offer. It’s best to stick to companies who are used to providing premium service.

Note: Almost all Mexican car insurance policies do NOT cover personal belongings left inside of a car. Vandalism and partial theft cover the vehicle itself, not things inside. Personal property coverage will be on a different policy, such as travel insurance, homeowners insurance, or renter insurance.

Liability vs. Comprehensive

Mexican car insurance is available as:

- Liability only: Legal requirement that pays others for damage you cause

- Comprehensive coverage: Extra coverage that helps repair/replace your property

At minimum, you must get liability coverage from a Mexico-based insurance company to drive legally in the country. Driving without this can spell serious trouble.

Note: Have you heard that some US and Canadian policies offer Mexico car insurance coverage? That can be true! But the catch is that non-Mexican policies usually do NOT provide required liability coverage. It’s almost-always property damage coverage for trips close to the border. And that’s it.

The cost of Mexican car insurance will be significantly more expensive for a comprehensive policy. But if you go with liability-only, your insurance will NOT pay to repair your vehicle. It also won’t cover your loss if the other party has inadequate (or zero) insurance.

For most people driving a high-value vehicle, comprehensive coverage is well worth the cost of the Mexican car insurance. But if you’re only bringing a low-value car to Mexico and don’t care too much about getting reimbursed for repairs or replacing it, then liability-only may be sufficient.

Wrap Up: The Best Mexican Car Insurance

Get your car insurance from a high quality broker that sells policies from reputable companies. Avoid brokers that only sell policies from one company or rely on subpar insurance companies. Look for exceptional customer support and longstanding tradition of being helpful.

To buy the best Mexican car insurance policy and know that you’re getting great coverage with expert support, head over to Baja Bound. An excellent alternative is Mexico Insurance Online.

Looking to visit Baja? Don’t miss our post on The Best Baja Books and Maps and Baja California Safety.

This information is for educational purposes only and does not constitute professional advice. Use at your own risk. Not liable for damages or injuries.

Is it possible to rent collision/comprehensive for a rental car (mid sized, unknown make model but nothing fancy) ahead of time with Baja Bound? I am wondering if I am going to get offered a hugely expensive insurance option when I pick the car up. Liability is built into the car reservation I made. My credit card is supposed to cover collision this but….. Thank you.

I recommend giving Baja Bound a call to see if they have any advice. I don’t think they’ll be able to provide a policy without the vehicle’s details, but perhaps there is a way.

Between your liability policy with the reservation and your credit card collision, it sounds like you have the combination that many experienced travelers depend on. Make sure the collision is through a high-quality credit card provider known for a relatively painless claims process, like Chase Sapphire. And make sure you pay for the rental on that card.

You may already know this, but it’s a good idea to have proof that you purchased the liability policy with your reservation. This is a known pain point with renting a car in Mexico.

Excellent information. Thank you

Thanks for leaving the comment, Lenka. We love helping people make the best decision possible and Mexican car insurance can be a little tricky.